Flexible Spending Accounts (FSAs) allow employees to set aside pre-tax dollars to cover either qualified medical expenses not covered by health insurance, dependent care costs, job-related mass transit or parking costs.

How much can the employees save?

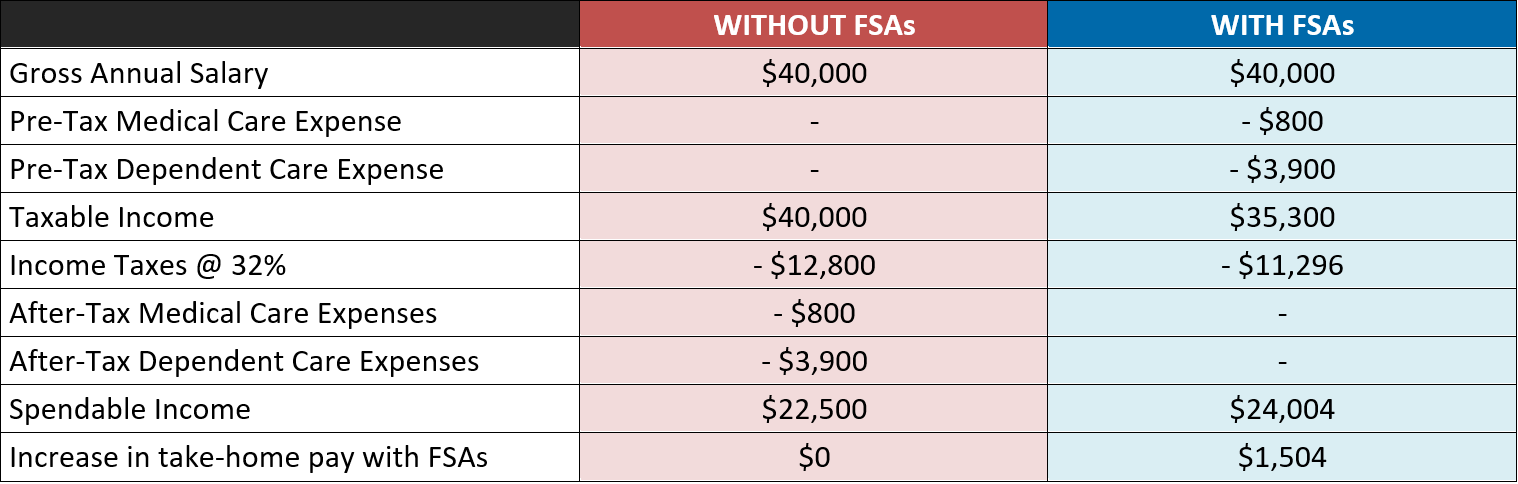

The amount employees save will vary depending on their individual tax situation, however, it is not unusual for employees to realize savings of 30% of their pre-tax payments for benefits. Generally, they will save on Federal, State, Local and FICA taxes.

The following is an example of how an employee can save money:

Amwins Connect Administrators recognizes the kind of personalized service the employer needs when evaluating the benefits of a cafeteria plan. As professional benefit administrators, we can help you make the right choices for your situation.

Flex Convenience Debit Card & Internet Account Access

- Provides plan participants with instant access to FSA account funds - no need to use out-of-pocket dollars

- FSA mobile app allows employees to access their account, request direct deposit and upload receipts and substantiation materials

Reporting

- Check registers to client after each check cycle

- Mail Quarterly FSA statements to all plan participants

- Provide Quarterly FSA reports to client

GBS FSA Administration

Implementation/Employee Communications

Includes:

- Summary plan description

- Explanation of FSA benefits brochure

- FSA election worksheets

Monthly FSA Administration

Includes:

- Process manual claim reimbursements

- Print reimbursement statements & checks

- Check register to employee

- Flex Convenience Debit Card

- Quarterly benefit statements to participants

- Year-end forfeiture report to employer

- Maintain participants' annual elections

For more information or to request a proposal, please contact sales@gbsio.net.